How Does The App Robinhood Make Money

Robinhood has made investing accessible for even the most inexperienced first-time investors. But while it has attracted millions of users with its no-fee, gamified approach, critics argue that the company's business model is not without risk.

Almost overnight, Robinhood gave millions of first-time investors easy access to the stock markets by making trading simple and, perhaps more importantly, free.

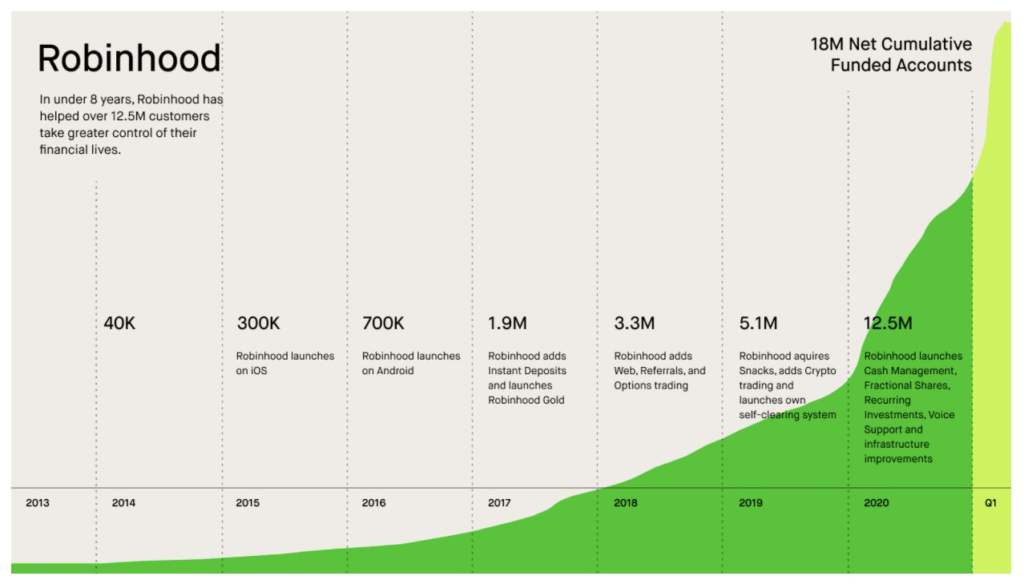

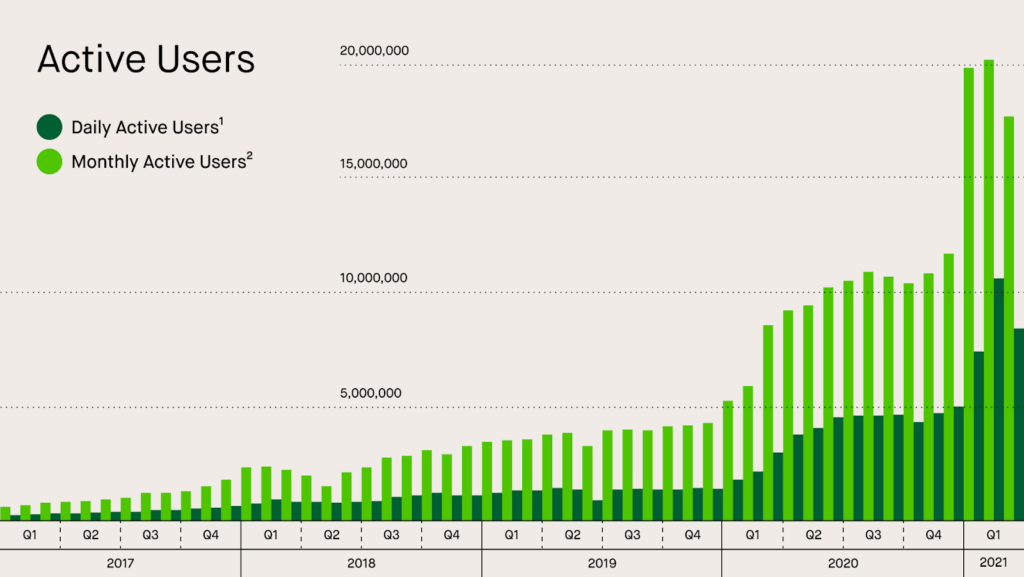

Since it launched in 2013, Robinhood has become one of the most popular and influential fintech apps in the world. Today, it boasts more than 18M funded users, up from just 500K in 2015. Targeting a $40B valuation ahead of its IPO, Robinhood makes much of its revenue from razor-thin margins on vast volumes of individual trades — a business model that is as lucrative as it is potentially precarious.

Robinhood has been the subject of much attention over the past year, amid retail trading mania, a record $70M FINRA fine, continued congressional scrutiny, trading outages, and ramping customer service problems.

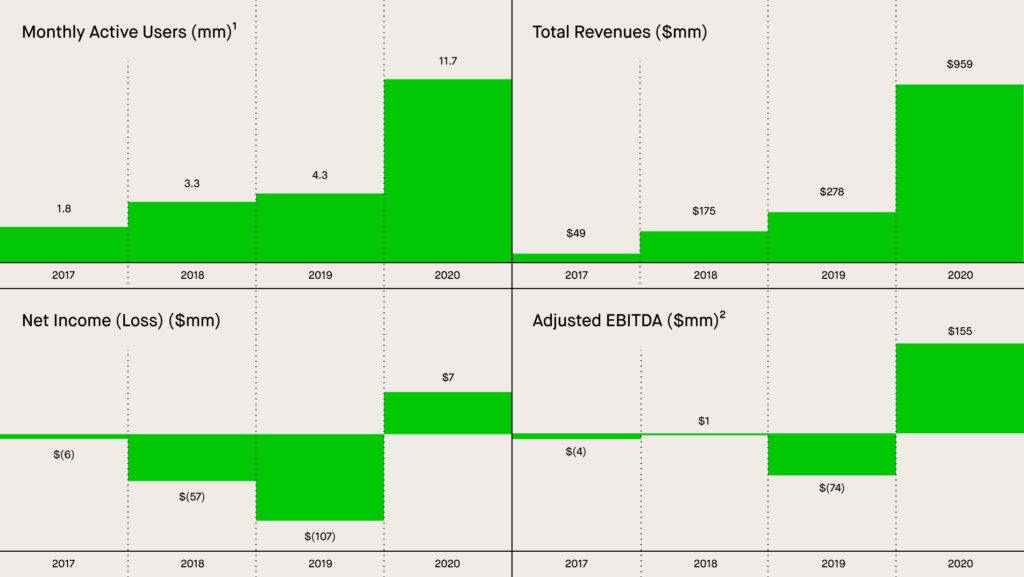

At the same time, its recent S-1 filing also revealed that Robinhood turned a profit of $7.3M in 2020 amid heightened attention and an astronomically growing user base, up from a $107M net loss the previous year.

The company captured $522M in revenue in the first quarter of 2021, quadruple the amount from Q1'20 — though net losses skyrocketed from $53M to $1.4B over the same period. Within Robinhood's Q1'21 order revenue, options trading accounted for the largest share (38% of its total revenue), followed by stocks (26%) and cryptocurrencies (17%).

Source: Robinhood

Source: Robinhood

In this report, we explore Robinhood's S-1, revenue and cost centers, competitive landscape, and areas of opportunity ahead of its IPO — as well as what the future might hold for the app that has almost singlehandedly transformed how online brokerages operate.

Table of contents

- How Does Robinhood Work?

- Pre-Robinhood: Rise of the free trading investment platform

- How trading on Robinhood works

- The competitive landscape

- How Robinhood Makes Money: Robinhood's Revenue Model And Cost Centers

- Payment for order flow

- Net interest revenue and Robinhood Gold

- Tertiary fintech products

- CAC vs. LTV

- Robinhood's regulatory and legal challenges

- Conclusion

How Does Robinhood Work?

Robinhood's primary means of driving revenue is making very small amounts of money on individual trades at scale.

It does this by attracting large numbers of users using incentives such as "free" stocks and commission-free trading, retaining those users and encouraging trading activity via behavioral triggers in the app, and earning razor-thin margins on those trades through a process known as payment for order flow (PFOF).

Prior to Robinhood's launch, getting started with investing could be difficult and time-consuming. With much of its revenue dependent on attracting large numbers of users, Robinhood had to lower the traditional barriers to entry in investing — and did so by challenging the status quo of the entire brokerage industry.

Pre-Robinhood: Rise of the free trading investment platform

Brokerages serve as middlemen that facilitate financial transactions on behalf of their clients. Customers maintain brokerage accounts with their brokers, through which investments are made by the brokerage. Funds held in brokerage accounts can be used to invest in a wide range of financial instruments, including bonds, exchange-traded funds (ETFs), mutual funds, and stocks.

Brokerages typically fall into one of two categories: discount and full service.

Discount brokerages are able to charge their customers less for services provided by reducing overheads such as physical locations. They usually charge lower commissions than full-service brokerages, but they don't conduct market analysis on behalf of their clients or offer investment advice. Because of this, discount brokerages are often synonymous with online brokerages.

Full-service brokerages typically charge higher commission fees, but offer a wider range of services including market research and investment advice. Many full-service brokerages have nationwide chains of brick-and-mortar locations, allowing customers to discuss their investment goals with an adviser in person.

Until fairly recently, investing was out of reach for many people. Choosing a brokerage required at least some knowledge of the markets, and commission fees made investing a potentially costly endeavor, with trades frequently cost between $8 to $10.

That changed in the wake of the financial crisis of 2008, when the first digital brokerages began to emerge, offering clients a new, lower-cost way to invest. These platforms quickly became a popular alternative to full-service brokerages.

Emerging in 2013, Robinhood has lowered the barriers that were once common to investing. The product's commission-free value proposition makes it easier for lower-income first-time investors to begin trading, and there are no minimum account requirements. Users can also trade fractional shares — fractions of a single share in a company, as opposed to a whole share. This makes investing in high-performance stocks, such as Apple, more accessible.

Further, Robinhood's app interface is designed to avoid overwhelming beginner investors with information.

This accessibility expands the platform's total addressable market (TAM) considerably by moving beyond typically older, wealthier individuals — who have at least some knowledge of investing — to younger and less experienced ones. The average Robinhood customer, for example, is 31 years old, while the average Charles Schwab customer is around 50.

Today, Robinhood has more than 18M funded accounts.

Source: Robinhood

How trading on Robinhood works

Before a user can begin trading on Robinhood, they must apply for an account. The Securities and Exchange Commission (SEC) requires all brokerages operating in the US to collect and verify the personal information of individuals trading on their platforms, including net worth and Social Security number.

The process can take up to a week, though most applications tend to be processed faster. Users must also connect a bank account so that funds can be transferred to and from their Robinhood brokerage accounts.

The Robinhood app differs from most online brokerage tools in 2 key ways:

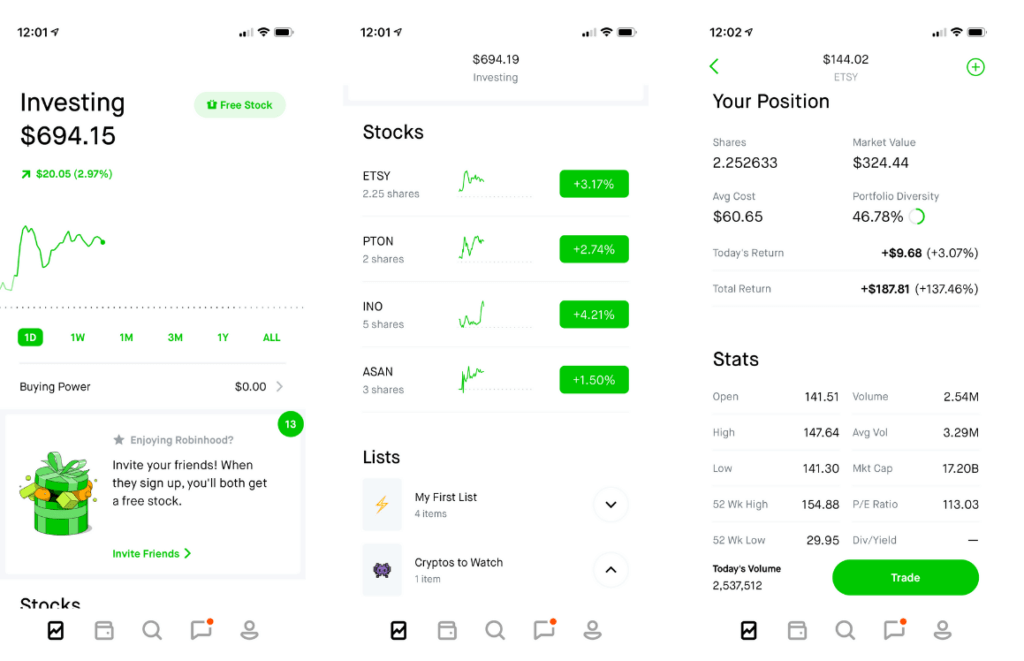

- It provides the user with only the most relevant information in an effort to reduce complexity.

- It encourages frequent use with behavioral triggers that reward certain actions.

Rather than risk overwhelming users by presenting them with the range of data offered by some professional trading tools, Robinhood keeps its information as streamlined as possible. For example, individual stock or crypto performance over time is displayed as a simple line graph. Users can find information on specific stocks with a typical search field.

Account holders' positions are summarized in green (positive) or red (negative), offering quick overviews of their entire portfolio. Shares or cryptocurrencies can be bought and sold with just 2 clicks on their ticker pages. Trades are shown as simple transactions in a user's account history in much the same way as deposits and withdrawals are displayed by banking apps.

Source: Robinhood

But simplicity is only half of the equation. The other half is Robinhood's use of behavioral triggers and rewards.

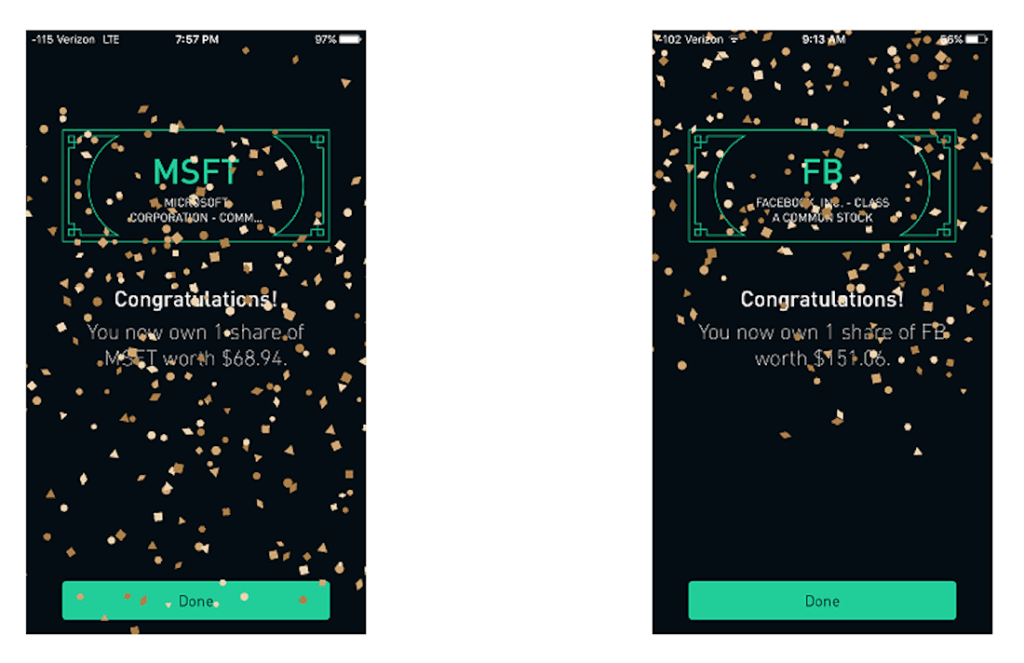

The gamified elements begin as soon as customers start interacting with the app. One of Robinhood's promises is that new accounts receive a free stock — a single share of a company determined at random. While new users could receive a share in a company like Apple or Tesla, Robinhood acknowledges that it's unlikely. New users have a 98% chance of receiving a stock valued at between $2.50 and $10 — but the incentive is still there.

Much of Robinhood's user experience is rooted in positive reinforcement and short-term reward structures. When account holders make their first deposit, they receive a congratulatory message saying that funds have been made available immediately so they can start trading. Free stocks serve as a referral engine to drive other people to the product. Robinhood also sends push notifications to alert users of movements in their positions, bringing them back to the app.

Source: Robinhood via Wallet Hacks

One of the criticisms often leveled at Robinhood is how its gamified approach to investing obscures the risks of playing the market with mechanisms designed to be inherently addictive. These elements are sometimes known as "dark patterns."

These design choices, coupled with the lockdowns necessitated by the Covid-19 pandemic, are believed to be responsible for the approximately 3M new users that Robinhood gained in the first 4 months of 2020. These so-called "pandemic day traders" traded 9x as many shares as E-Trade users and 40x as many shares as Schwab users during Q1'20. They also traded 88x as many risky options contracts as Schwab users during that period.

The growth has only continued: monthly active users topped 20M in Q1'21.

Source: Robinhood

Criticisms of Robinhood's practice of targeting inexperienced investors intensified in June 2020, following the death by suicide of a student at the University of Nebraska, who had seen a seemingly negative balance indicator of $730K in the Robinhood app.

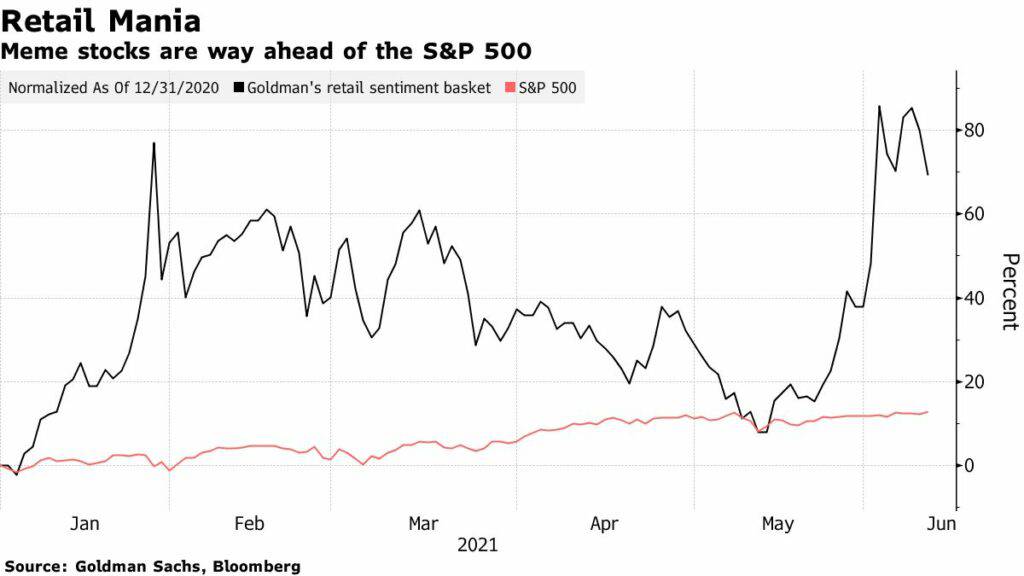

Meme stock trading exploded in the early months of 2021, incited by members of the WallStreetBets subreddit. Amateur day traders pumped the stock prices of ailing companies like Best Buy, AMC, and Best Buy, partially in effort to stick it to hedge funds, partially to just have fun, partially to make some money. A significant portion of these retail traders turned to Robinhood to execute these trades, flooding the app with so many orders that it was forced to halt trades — which later drew regulatory scrutiny.

"The way to become a meme stock is not just to be good; companies don't become meme stocks because Redditors endorse a widespread consensus that they are good operators in attractive markets," writes Bloomberg's Matt Levine. "The way to become a meme stock is to be bad, then good; companies become meme stocks because Redditors get mad at hedge funds for shorting them, so they buy them, so they go up, and it's fun and more Redditors join in."

Source: Bloomberg

Famed investor Warren Buffett has criticized the stock trading app, referencing the "casino aspect" of the stock market.

"There's nothing illegal about it, there's nothing immoral. But I don't think you build a society around people doing it," Buffett said at Berkshire Hathaway's annual shareholders' meeting in May 2021.

The competitive landscape

Robinhood is predominantly competing with legacy retail brokerages that have adopted Robinhood's core value proposition of commission-free trades.

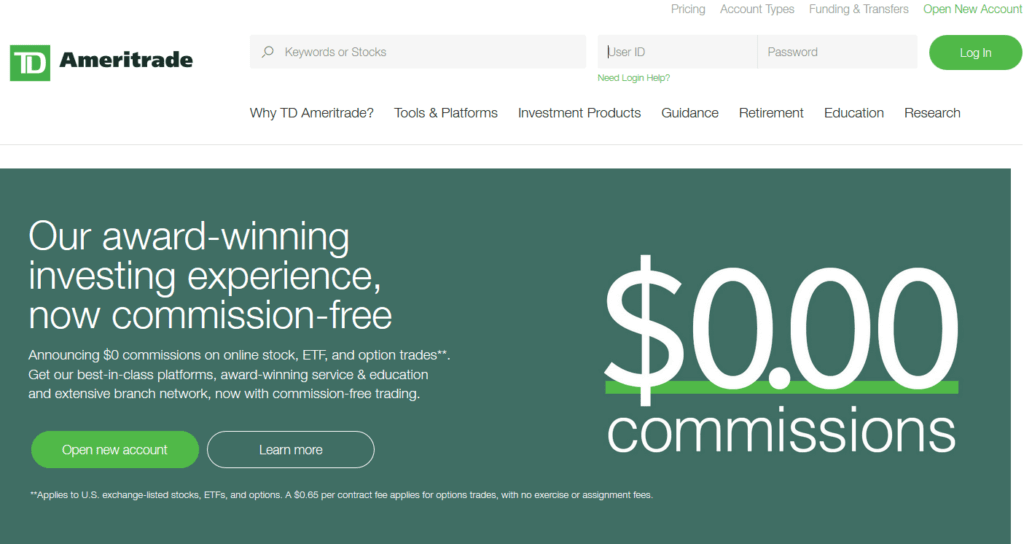

When Robinhood launched in 2013, no other major brokerage offered zero-commission trading. The company remained an outlier in this regard until October 2019, when Charles Schwab, E-Trade, and TD Ameritrade all announced they would no longer levy commissions on ETF, options, and stock trading.

Source: TD Ameritrade

At the time, many analysts believed that dropping commission fees was a major misstep. Robinhood posed little meaningful threat to the business of major retail brokerage firms, and mimicking a startup's already precarious business model would ultimately harm revenues.

But those fears turned out to be unfounded. Zero-fee trading is now considered the norm, and even well-established brokerages have been forced to adopt increasingly defensive positions as Robinhood has grown.

While established retail brokerages have long been Robinhood's primary competitors, they are far from the only ones. Many other digital brokerages and adjacent services have emerged in recent years, with the majority acting in the business-to-consumer (B2C) space.

Robinhood Crypto, launched in 2018, directly competes with cryptocurrency brokerages like Coinbase. In Q1'21, 9.5M customers traded cryptos like Bitcoin, Ethereum, and Dogecoin on the platform — a 458% increase from the previous quarter.

Where Robinhood Crypto is comparatively weaker is in its lack of transfer or withdrawal capabilities: customers currently cannot transfer their crypto assets into or out of their account. It also holds some $11.5B of cryptocurrencies as of Q1'21, while market leader Coinbase holds nearly 20x that amount ($223B, including $122B being held by institutions).

However, the bulk of newer digital brokerages are not competing with Robinhood directly, and favor comparatively niche markets or provide investment products alongside more mainstream financial services. For example, micro-investment services such as Acorns and Stash appeal to first-time investors with lower incomes, while services such as Stockpile focus exclusively on fractional shares.

Firms such as SoFi provide a range of financial services, from investing and home loans to student loan refinancing and credit card products. Others, like StashAway, combine online investing with more traditional banking services, including savings accounts. This diversity of choice may benefit financial consumers, but it also means greater competition for the same users and an increasingly fractured market for investment products and services.

Because "free" is no longer a meaningful competitive differentiator, Robinhood has been forced to attract more new users than legacy brokerages to capitalize on its high-volume, low-margin model.

Fortunately for Robinhood, it appears that these legacy brokerages are less motivated to pursue the lower-value, first-time investors that compose much of its user base. The company has seen explosive user growth over the last several years, rising from 1M account holders in 2016 to over 18M in 2021.

While other fintech startups have seen strong user growth in recent years, they still trail Robinhood. Acorns, for example, grew its user base from 3.5M users in 2018 to 8.2M in 2020, while Stash counts 5M users. Like Robinhood, SoFi experienced dramatic growth in 2020, and in June 2021, it debuted in a $8.7B SPAC.

Furthermore, as of Q1'21, Robinhood boasts an average revenue per user (ARPU) of $137.

Robinhood could look to further reduce the barriers to entry in investing by offering an automated investment product alongside more mainstream banking services. Platforms such as Acorns and Wealthfront have experienced strong growth thanks in part to their automated investment features. Robinhood is in an advantageous position to do the same if it can offer a compelling alternative to conventional banking products and present investing as a passive, low-risk activity suitable for casual first-time investors.

How Robinhood Makes Money: Robinhood's Revenue Model And Cost Centers

Robinhood has diversified its product offerings to appeal to a broader range of financial consumers, and the company has made several decisive moves that signal its intention to pursue greater market share of the fintech space. However, its primary revenue centers remain the tiny margins the company makes on high-frequency, high-volume trading, which accounts for 75% of its revenue.

Payment for order flow

Robinhood's initial sign-up page described the service as "The world's $0 commission stock brokerage." It encouraged visitors to "Stop paying $10 for every trade," a value proposition people found so compelling that the product had nearly 1M sign-ups before going live.

Source: Robinhood via Web Archive

Although Robinhood was among the first zero-commission online brokerages, payment for order flow (PFOF) — the mechanism by which the company could offer fee-free trades, and its primary revenue center — was far from new.

PFOF is a controversial practice in which brokerages direct third parties known as "market makers" to execute trades on their behalf. For Robinhood, the process would look like this:

- First, an investor places an order to buy or sell stock via the Robinhood app.

- Next, Robinhood passes that order on to a market maker such as Citadel Securities or Two Sigma Securities, which actually executes the trade. The market maker pays Robinhood — typically, fractions of a cent — for those orders.

- Finally, the trade is executed by the market maker, which profits on the transaction by buying shares at slightly lower prices than the price at which those shares are sold. This difference is known as the bid-ask spread.

This process eliminates the need for Robinhood to handle the complexities of executing trades itself. It also benefits market makers by giving them access to vast volumes of trades.

In 2020, 34% of the company's PFOF revenue came from market maker Citadel Securities, followed by Susquehanna International Group (18%) and Wolverine Holdings (10%).

Market makers "generally have more information and processing power than retail traders and brokers," according to the SEC. Theoretically, this makes them the ideal middlemen for high-volume transactions. But PFOF, which was pioneered by disgraced former investment banker Bernie Madoff, is controversial due to its lack of transparency.

Per SEC Rule 605, market makers are legally bound to provide the best possible quality of execution for each trade. "Quality of execution" refers to how close the fill price — the actual cost of a security, as opposed to its theoretical price — is to the bid or asking price of that security. But while market makers are legally compelled to seek the best possible execution of trades for their clients, they are not compelled to provide the best possible price. This can result in market makers executing trades at prices that are profitable for them, but may not be in the best interests of the trader.

Robinhood is not the only brokerage to capitalize on PFOF. Other brokerages such as Charles Schwab and E-Trade make money from PFOF, albeit significantly less than Robinhood — PFOF accounts for just 3% of Schwab's revenues and 17% of E-Trade's revenues. Prior to its acquisition by Schwab in 2019, TD Ameritrade reported that its payments for order flow were roughly a tenth of a penny per share, and E-Trade reported similar figures.

Robinhood's heavy reliance on PFOF has caused it significant legal headaches. The Financial Industry Regulatory Authority (FINRA) fined Robinhood $1.25M in December 2019 for "best execution violations," and in December 2020 the SEC charged the company with misleading its customers, which led to a $65M fine.

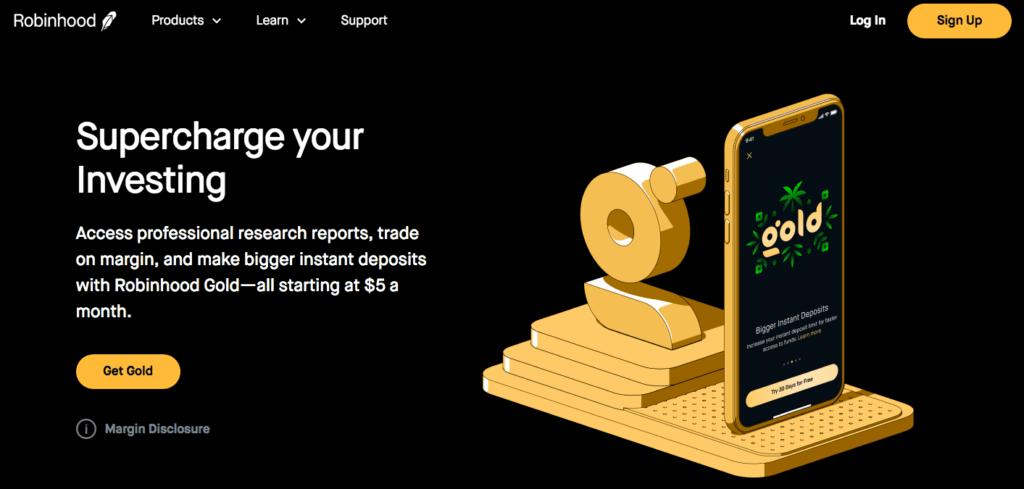

Net interest revenue and Robinhood Gold

Net interest revenue — the second-largest source of revenue for Robinhood — encompasses the money Robinhood makes from securities lending and margin loans.

Margin lending allows Robinhood customers to buy stocks using funds borrowed from Robinhood. Margin loans allow traders to seize opportunities and invest in instruments without necessarily having the cash on hand to do so.

Robinhood also earns subscription revenue from Robinhood Gold, a premium subscription plan that accounts for approximately 7% of its net revenue. Robinhood Gold saw paid subscriptions surge from 300K in Q1'20 to 1.4M in Q1'21.

Benefits include instant deposits, real-time pricing data from Nasdaq, and professional research reports on 1,700 stocks prepared by Morningstar. Gold costs a fee of $5 per month, in addition to 2.5% interest for the margin amount borrowed over $1,000.

Source: Robinhood

Margin loans offer traders additional flexibility to make timely investments. At the same time, in the event of a margin call, investors may find themselves even deeper in the red if the value of their investment falls. Margin calls occur when investments in an investor's margin account fall below a specified value known as the maintenance margin. When this happens, the account holder must deposit additional funds or sell securities to meet the maintenance margin expectations set by the brokerage.

The interest and fees from Robinhood's margin lending are a major source of revenue, accounting for 12% of its net revenue in 2021. The more margin a customer uses, the greater the interest. However, Robinhood's margin lending has also been a source of embarrassment for the company.

In 2019, members of a subreddit community called WallStreetBets (WSB) discovered an exploit in Robinhood's margin lending system that allowed them to secure vastly inflated margin limits with comparatively small deposits. The exploit was first publicized in January 2019, when one user leveraged his margin account to $200K with a deposit of just $5K. Another user demonstrated how to take advantage of the exploit during a livestream in October 2019, which resulted in significant media coverage.

However, despite the well-publicized nature of these exploits, which came to be known in the investing community as the "Robinhood Infinite Money Cheat Code," Robinhood failed to take action. In November 2019, another member of the WSB subreddit managed to leverage a $950K Tesla position and a $425K Apple position — all with a deposit of just $15K. The vulnerability was closed that month and accounts that were found to have used the exploit were suspended.

Tertiary fintech products

Robinhood has never been particularly coy about its intentions to expand beyond its core online brokerage business into other areas of the fintech and neobank markets.

In late 2018, Robinhood announced Checking & Savings, a more traditional banking product that the company claimed would be available in early 2019. Robinhood's proposed bank account products weren't terribly exciting, except that Checking & Savings would offer interest rates of 3%.

At the time of the announcement, average interest rates for savings accounts ranged from 0.10-0.21%, making Robinhood's forthcoming accounts among the most generous on the market. With zero fees and high interest rates, Robinhood seemed poised to transform checking accounts as it had online brokerages.

Source: Robinhood via Bankrate

But Checking & Savings never materialized.

Ordinarily, deposits made to checking and savings accounts are guaranteed by the Federal Deposit Insurance Corporation (FDIC). Robinhood claimed that deposits of up to $250K made to its Checking & Savings accounts would instead be insured by the Securities Investor Protection Corporation (SIPC).

However, the SIPC only guarantees funds deposited in brokerage accounts for the sole purpose of purchasing securities — a fact that the SIPC put in no uncertain terms when it issued a statement contradicting Robinhood's claims. Robinhood backpedaled and withdrew its plans for Checking & Savings.

Despite its problems with Checking & Savings, the incident did not deter Robinhood from pursuing other commercial banking products.

In October 2019, the company announced the Cash Management account and associated debit card. Similar to Checking & Savings, Cash Management accounts are completely free — with no fees or minimum balances. The card was launched in partnership with Mastercard, giving cardholders access to fee-free withdrawals from more than 75,000 ATMs.

All funds deposited to Cash Management accounts are guaranteed by the FDIC, and account holders earn 0.30% APY on the cash available in their Robinhood brokerage accounts — a percentage that aligns much more closely with the rates offered by most commercial banks. The feature was made available to all Robinhood users in 2020, with 3.4M customers signing up for the cash management and debit card offering as of March 2021.

Source: Robinhood

Robinhood isn't responsible for the interest payments offered to Cash Management cardholders. Instead, the company moves cardholders' funds into a network of FDIC-insured partner banks, which pay the interest on those deposits. The 6 partner banks pay fees to Robinhood, and the company also takes a small cut of the interchange fees levied on transactions made with its Cash Management debit cards.

Cash Management represents a shift in focus that other fintech companies are also making. Betterment, which was the first robo-adviser to emerge following the financial crisis of 2008, is making similar moves with its Everyday high-yield savings product.

Betterment initially started with an IRA product before moving into tangential areas such as retirement planning, tax management, and investing. Robinhood appears to be following a similar trajectory that will diversify its revenue streams by offering complementary financial services to users of its core brokerage product.

CAC vs. LTV

Cost-effective customer acquisition is crucial for Robinhood, given that its business model hinges on high-volume, low-margin trading. While the company has been reluctant to divulge specifics about its customer acquisition costs (CACs), it appears that the company has been able to keep these comparatively low.

In 2018, E-Trade spent $170M to purchase more than 1M brokerage accounts (representing $18B in assets) from Capital One Financial, placing the value of these accounts at roughly $170. Speaking about the transaction during a conference call, an E-Trade executive remarked that this was "well below our typical customer acquisition costs for a broad set of customers that meet our target profile," suggesting that E-Trade's CACs are typically higher than the $170 it paid per brokerage account.

It's important to note that large-scale acquisitions of brokerage accounts like this are relatively rare, and that the clients represented by those accounts did not trade as frequently as a typical E-Trade client, which may be indicative of lower account value.

Per its S-1, Robinhood's average cost to acquire a new funded account dropped 60% from $53 in fiscal 2019 to $20 in fiscal 2020. In the first quarters of 2020 and 2021, the average CAC halved from $32 to $15.

The company's strong referral program is likely responsible for keeping CACs so low. However, while Robinhood's CACs appear to be significantly lower than those of retail brokerages, the value of Robinhood accounts is also lower: the median customer account size is $240 while the average account size is about $5,000, according to Robinhood CEO Vladimir Tenev. For comparison, prior to E-Trade's acquisition by Morgan Stanley in 2020, the company's average brokerage account was estimated to be worth around $69K. Morgan Stanley's average account value is even higher, at approximately $175K.

Robinhood may be winning battles in terms of customer acquisition, but established brokerages are clearly winning the war when it comes to account value.

But this is not necessarily a negative. For one, it allows Robinhood to pursue new users that large, legacy brokers might typically overlook. The company has also been able to successfully transform its rapid user growth into strong funding rounds, regardless of the value of the users it has attracted.

Robinhood's primarily younger user base is promising from a growth perspective, but the lifetime value (LTV) of its accounts is likely significantly lower than those of larger, well-established retail brokerages. However, these users can be packaged into and targeted with adjacent product offerings that can drive additional revenue for Robinhood, such as debit cards.

While Robinhood's accounts may be less valuable than those of the legacy brokerages, it currently commands one of the highest rates on equity trades of any brokerage, at 17 cents per 100 shares. By comparison, Schwab makes 11 cents per 100 shares.

Robinhood's regulatory and legal challenges

Arguably, the greatest potential cost center for Robinhood is its vulnerability to broader regulation of the financial sector and fintech products.

Robinhood operates in a somewhat precarious gray zone in terms of regulatory legality — which could imperil a significant part of its revenue in the event of broader regulatory overhaul. While this kind of regulatory reform is unlikely in the short term, it remains a crucial vulnerability for a company that has already had its fair share of run-ins with the SEC.

"Robinhood's revenue model could easily disappear. They've made it clear that they are comfortable living on this regulatory edge." — Tyler Gellasch, executive director, Healthy Markets

Another potentially significant cost center that Robinhood faces is litigation, though these represent comparatively small amounts.

The company was recently slapped with a historic $70M fine from FINRA, which issued a statement reading: "FINRA considered the widespread and significant harm suffered by customers, including millions of customers who received false or misleading information from the firm, millions of customers affected by the firm's systems outages in March 2020, and thousands of customers the firm approved to trade options even when it was not appropriate for the customers to do so."

Robinhood's legal problems are not exclusively regulatory in

nature. In March 2020, a user filed a class action suit against the company following a 2-day service outage that month — which happened to occur during the largest one-day point gain in the history of the Dow Jones Index.

Following the GameStop trading mania, Robinhood has faced a slew of legal battles (including dozens of class action lawsuits) relating to systemwide outages, trading restrictions, PFOF practices, and data privacy. It is also the focus of an SEC investigation into trading halts amid the GameStop trading frenzy in early 2021.

Robinhood's legal liability is unlikely to have a significantly detrimental impact on its finances in the mid- to long term, but it may cause problems for the company ahead of its IPO.

Pennies On The Dollar

In less than a decade, Robinhood has profoundly disrupted an industry traditionally hostile to newcomers.

While Robinhood may not be competing with established retail brokerages for the same users, it will still have to work hard to entice new users to open brokerage accounts — even if the terms of its tangential financial products, such as Cash Management, are more favorable than those of competitors.

The company will also likely have to focus on increasing the value of its average user, rather than on sheer volume alone. Robinhood may have strong user growth, but its competitors have significantly more assets under management.

Further, it will have to work hard to increase the value of its accounts to justify its recent valuation — especially in the context of the risks posed by attracting inexperienced investors new to the markets.

This report was created with data from CB Insights' emerging technology insights platform, which offers clarity into emerging tech and new business strategies through tools like:

- Earnings Transcripts Search Engine & Analytics to get an information edge on competitors' and incumbents' strategies

- Patent Analytics to see where innovation is happening next

- Company Mosaic Scores to evaluate startup health, based on our National Science Foundation-backed algorithm

- Business Relationships to quickly see a company's competitors, partners, and more

- Market Sizing Tools to visualize market growth and spot the next big opportunity

If you aren't already a client, sign up for a free trial to learn more about our platform.

How Does The App Robinhood Make Money

Source: https://www.cbinsights.com/research/report/how-robinhood-makes-money/

Posted by: trainordebtled.blogspot.com

0 Response to "How Does The App Robinhood Make Money"

Post a Comment